Great news for Malaysian SMEs! The government has officially announced a major recalibration of the e-Invoicing implementation timeline. In a move aimed at preserving the operational stability of the grassroots economy, Prime Minister Datuk Seri Anwar Ibrahim confirmed that MSMEs with an annual turnover of less than RM1 million are now officially exempted from mandatory e-Invoicing.

For SME manufacturers and distributors, the government’s timeline recalibration offers a valuable opportunity to align with upcoming standards at your own pace. Rather than a simple pause, this exemption period serves as a strategic head start. It allows SMEs to focus on refining their data quality and operational readiness so that when the mandate widens, compliance becomes a natural by product of your daily workflow rather than a disruption.

Official LHDN guidance reinforces this proactive approach. Section 1.6.6 of the e-Invoice Guideline encourages businesses to utilize this time to align with the national initiative, while Section 1.6.8 notes that exemptions are subject to review. This makes the grace period the perfect window to “future-proof” your operations comfortably.

To use this time effectively, it is helpful to understand exactly what the “e-Invoice Standard” entails. A common misconception is that simply generating a PDF invoice is sufficient for compliance.

LHDN’s definition of an e-Invoice is quite specific. According to Figure 1.1 (Pages 8 & 9) of the Guideline, a compliant e-Invoice is a structured file (XML or JSON) designed for system-to-system validation. The guideline clarifies that visual documents like PDFs, DOCs, or emails do not meet the standard because they cannot be automatically processed by the government’s servers.

Why Data Integration is the Key

The core requirement of the standard is data validity. The government’s system validates your invoice data in near-real-time. If your operational data (Sales figures, Inventory counts, Tax codes) are siloed and managed manually, you inevitably face errors and inconsistencies caused by repetitive key-ins. As a result, your e-Invoice files will simply fail validation, creating a bottleneck for your finance team.

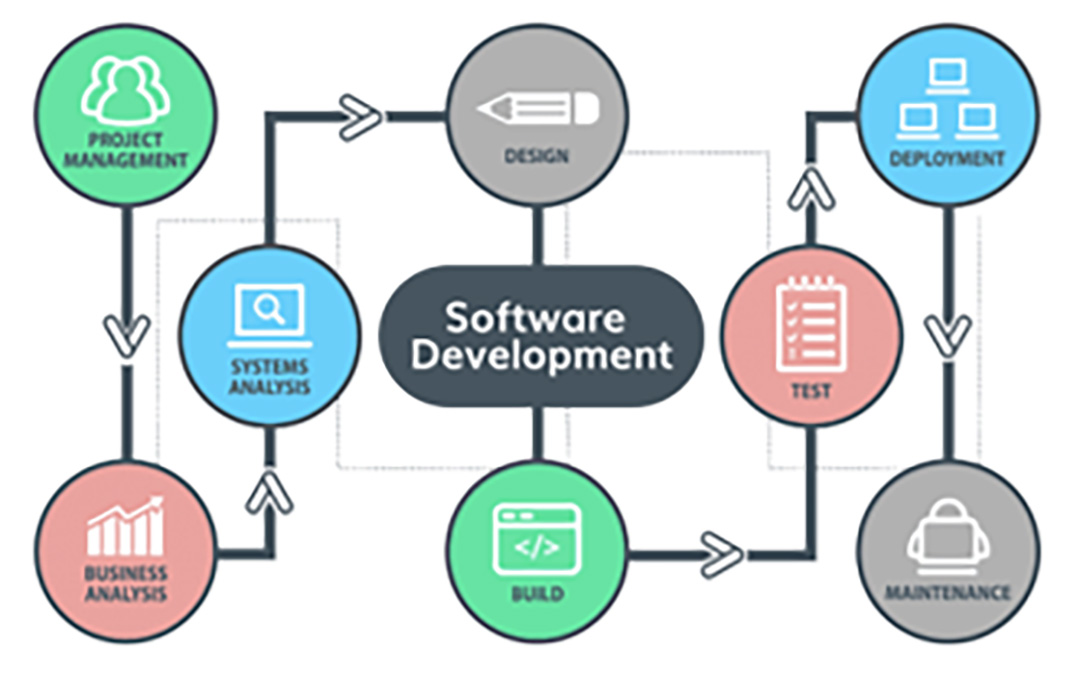

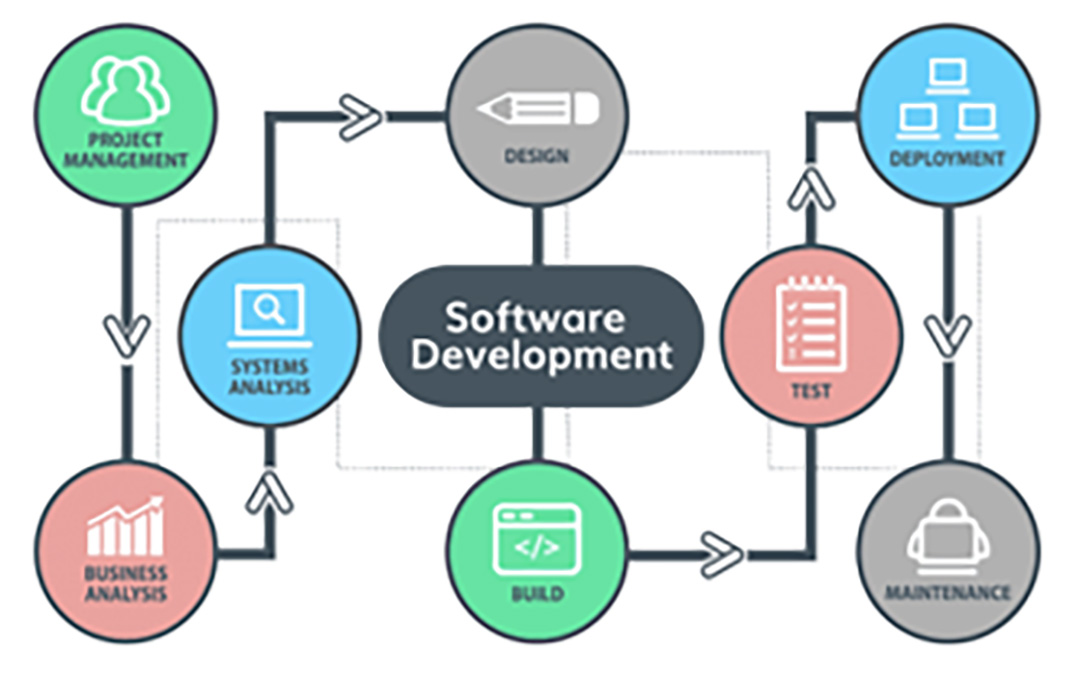

This is where having a digital ecosystem with integrated solutions becomes valuable. To ensure data consistently meets strict government standards, finance departments are increasingly relying on online accounting software malaysia that is enhanced by artificial intelligence business solutions and fully connected to their sales team’s mobile sales app. This synchronization ensures that data flows in real-time between departments, eliminating the “gap” where errors usually occur.

How Integrated Solutions Support Accuracy: Within this ecosystem, tools like mobile sales apps with AI-powered OCR act as a quality filter. They enable Automated Document Transformation, a technology that works in the background to seamlessly convert source documents into downstream transactions. By eliminating the need for manual data entry, these solutions ensure that the data flowing into your General Ledger (GL) is accurate and “clean” by default.

The Result: Because your underlying numbers are error-free, your system can automatically generate the required XML/JSON formats that pass validation instantly, keeping your business compliant without extra effort.

Achieving e-Invoicing readiness isn’t about buying a specific “tax plugin”; it is about ensuring your four core financial cycles: O2C, P2P, Inventory, and R2R, are digitized to meet strict government auditing standards.

Research on SME digitalization indicates that automated accounting systems significantly reduce human error and improve decision-making speed compared to manual processing. Here is how you can optimize these cycles to ensure you pass the “LHDN Standard.”

The LHDN Standard: For an e-Invoice to be compliant, it must represent a valid, collectible transaction. Issuing invoices to customers who cannot pay creates “Bad Debt,” which complicates your tax filings. Under LHDN standards (See Section 5.3.2), you must prove you have taken steps to recover debt before claiming relief; preventing bad debt at the source is far safer for compliance.

The Business Scenario: The challenge in General Trade is often high sales but slow collection. Sales reps, eager to hit targets, may push stock to retailers who haven’t paid bills in months. This inflates your Days Sales Outstanding (DSO): the average time it takes to get paid, and puts your cash flow at risk.

The Digital Solution: Malaysian businesses can use mobile sales app integrated with online accounting software that enables using Accounts Receivable (AR) Aging reports to enforce strict Credit Control. The right online accounting software Malaysia should serve you the following justice:

Back to Compliance: This digital gatekeeping ensures that every e-Invoice generated is backed by a credit-worthy transaction. It prevents the inflation of revenue figures with bad debt, ensuring your Revenue Reporting to LHDN remains accurate and audit-proof.

The LHDN Standard: While the LHDN server validates your data format, Section 2.3.6 and 2.4.5 of the e-Invoice Guideline empowers your buyer to formally “Reject” an e-Invoice within 72 hours of validation, for Portal and API users respectively. In practice, buyers will exercise this right if your invoice data (Output Tax) does not strictly match their Purchase Order (Input Tax). A rejection in the MyInvois portal leaves a permanent “cancelled” mark on your compliance record, requiring you to issue a Credit Note or replacement invoice.

The Business Scenario: A major compliance gap often occurs during the PO-to-SO conversion. When admin staff manually re-type a customer’s PDF Purchase Order into the system, errors are inevitable. These aren’t just typos; they are rushed manual key-in errors caused by the frustration of updating separate systems (Sales vs. Accounting) and the intense pressure to enter orders quickly for Sales Closing deadlines. Under the new standards, these simple typos now result in official rejections. Therefore, choosing the right accounting solutions is also very important for businesses, and FAV365 Accounting Solutions is one of the favourite choices of Malaysian SMEs & Accountants, because it is a All In ONE full set accounting software that allows the business user to manage their sales, purchase, collection, inventory and accounts.

The Digital Solution for Malaysian SMEs: See advanced online accounting software Malaysia that can integrate with mobile sales app equipped with artificial intelligence business solutions to bridge this gap.

The Mechanism: The OCR from the artificial intelligence business solutions scans your customer’s PO and auto-converts it into an internal Sales Order (SO) with zero manual data entry. Furthermore, the AI-powered Mobile Sales App Solution automates 3-Way Matching, using real-time data of PO, Goods Received Note, and Invoice uploaded by salesman from the mobile sales app that is integrated with accounting, ensuring you only pay suppliers for verified goods.

The Result: This automation secures your revenue cycle by reducing manual errors and ensures strategic AP management, paying on time to maintain supplier trust without overpaying.

Back to Compliance: By automating data entry through quality digitalisation, you ensure absolute Data Consistency. The e-Invoice you generate matches the source document perfectly, effectively “rejection-proofing” your invoices against the 72-hour buyer window. Furthermore, 3-Way matching ensures your own Input Tax claims are substantiated by verified GRNs, providing critical evidence required to defend your expenses during an LHDN audit.

The LHDN Standard: Under Section 1.4 of the e-Invoice Guideline (Version 4.6), the e-Invoice is designated as the mandatory “Proof of Expense” for tax purposes. This means every Ringgit you claim as Cost of Goods Sold (COGS) must be substantiated by a validated e-Invoice. If your inventory records, and by extension your COGS, are inaccurate due to stock losses or unverified write-offs, you risk filing incorrect tax returns, which can trigger penalties for under-declaring income.

The Business Scenario: In mobile distribution (Van Sales), tracking inventory is notoriously difficult. Drivers may sell expensive “Cartons” as cheaper “Boxes” due to confusing Unit of Measures (UOM), or claim stock was “damaged” to hide theft. These discrepancies create “phantom” costs that inflate your COGS without the required supporting documentation.

The Digital Solution: Digitalization with a mobile sales app that is integrated with your online accounting software helps you create a closed-loop system for accurate costing.

The Mechanism: Malaysian businesses that chose a good online accounting software from an advanced digital ecosystem gain the ability to sync inventory movements from the mobile sales app to the accounting ledger in real-time. If the mobile sales app forces multi-level UOMs input for each SKU on the driver salesman, with this kind of mobile sales app integrated with an accounting software that strictly monitors Write-Offs, drivers cannot simply “delete” stock; they must upload evidence for damaged goods, creating a mandatory digital trail that matches your compliance records.

The Result: This ensures your COGS is calculated based on real-time, verified data rather than estimates, protecting your gross margins and ensuring your financial reports reflect reality.

Back to Compliance: Proper digitalisation like the above helps you create a defensible Audit Trail. Since e-Invoices are now the primary “Proof of Expense”, having digital evidence for every stock movement and write-off ensures your COGS figures are auditable. Moreover, when LHDN reviews your expenses, you can prove exactly why specific items were written off, ensuring your tax declarations are accepted without dispute.

The LHDN Standard: Section 1.2 of the e-Invoice Guideline states that the system is designed to facilitate “efficient and accurate tax reporting” through seamless integration. Furthermore, Section 1.4 explicitly defines the e-Invoice as the mandatory “Proof of Income” and “Proof of Expense”. Consequently, your internal financial statements must align perfectly with the e-Invoices submitted to the portal; any discrepancy between your ledger and these official “Proofs” serves as an immediate red flag for auditors.

Therefore, adopting proper e-Invoicing practices with the right solution is crucial for businesses. It helps reduce non-compliance risks while giving business owners clear visibility into their performance through accurate, real-time tracking.

Back to Compliance: By automating digitally with a well-integrated digital ecosystem, you create yourself a permanent Liability Shield and an unbreakable Audit Trail. According to Section 2.3.3 of the Guideline, every validated e-Invoice is assigned a “Unique Identifier Number” specifically to allow for “traceability by IRBM”. With the help of a fully integrated online accounting software and AI-equipped mobile sales app, you ensure strict adherence to this traceability. If a sales rep attempts to alter an invoice after it is posted, the system prevents a silent overwrite; instead, it logs the specific user, time, and nature of the change. This eliminates “mystery changes” in your ledger, ensuring that every figure in your financial report matches the government-validated Unique Identifier and saving you from having to explain discrepancies during an audit. For good digital accounting systems, see online accounting software Malaysia.

This exemption is a positive development, but it also serves as a clear signal: the national trajectory is moving toward total digital integration. With government data confirming that the digital economy is a significant driver of Malaysia’s future, the path to sustainable e-Invoice compliance isn’t about simply buying a “tax plugin” to patch a hole.

It is about establishing a robust digital ecosystem where your operational data, from the salesman’s mobile sales app to the accountant’s ledger, is seamlessly connected and inherently auditable. We encourage SME owners to utilize this grace period to transition from disjointed manual processes to a unified Digital Ecosystem. By leveraging integrated digital solutions backed by artificial intelligence business solutions, you grow and build a business that is compliant by design, ensuring you meet strict LHDN standards naturally as part of your daily workflow, rather than by chance.

Ultimately, achieving e-Invoicing readiness is not just about satisfying a government mandate; it distinguishes businesses with a fixed focus from those with a growth mindset. For the latter, this transition is viewed not as a burden, but as an opportunity to build a business that creates sustainable value.

However, realizing this vision requires more than just software; it demands the right digitalization partner, one who understands that technology must serve operations, not the other way around.

This is the exact journey of operational refinement we have navigated alongside local and international FMCG brands, global nutrition giants, multinational tobacco leaders, and major hypermarket chains, proving that the right digital foundation transforms complex compliance into seamless efficiency. We invite you to explore how digital ecosystems with integrated solutions can bridge the gap between your daily operations and strict regulatory demands. With the right support, you can use this exemption period to build a business that is not just compliant by design, but operationally agile and financially stronger than ever.

LinkedIn : MC Crenergy | Datanory | IT Solution Provider

Updated On : 23 Dec 2025

MC Crenergy Sdn Bhd

No. 200801020316 & No. 821628A

H-5-2, Setiawalk,

Persiaran Wawasan,

Pusat Bandar Puchong 47160,

Puchong, Selangor Darul Ehsan, Malaysia.

Email: info@crenergy.com.my

Contact:

(+6) 03 8600 7097 (General)

(+6) 019 277 1628 (Support)

(+6) 011 5551 8838 (Consultant)

Expand your business with personalised automation.

Every business has its own culture, procedure, and processes; there is no one-size-fits-all software in the market to fit all unique needs and requirements without compromising on results.

By knowing what clients are facing, their challenges, requirements and expectations, we are able to deliver a tailored-fit, customized solution with a higher success rate, shorter adaptation period, and greater flexibility.

MC Crenergy has the experience and expertise to customize technology that empowers client’s operations. A customized solution that fits client’s needs perfectly, reducing friction and resistance, while promoting greater success in adaptation & business performance.

2 thoughts on “Chinese New Year Campaign 2022”

Thank you and happy chinese new year

Happy Chinese New Year to you & hope you enjoy our campaign & service.